Everyone driving a vehicle on Texas roads is required by law to carry automobile insurance covering them and other drivers involved in an accident.

If you are in an accident or minor incident on the road, your insurance and that of any others involved will kick in and pay for medical costs and vehicle repairs. Texas law requires vehicle owners to have what’s known as 30/60/25 insurance — the most basic coverage that pays $30,000 per person for injuries, up to $60,000 per accident, and $25,000 for damage to vehicles.

Depending on your vehicle, though, you may need a different type of motor vehicle insurance. For example, driving an 18-wheeler or other commercial truck will require higher insurance coverage.

Areas in Greater San Antonio We Serve

But while it may seem relatively simple and straightforward to file a car insurance claim in Texas, the reality is often different. An insurance carrier will want to pay out as little as possible — sometimes nothing — so your payout doesn’t cut into its profits, especially if you can’t prove you were not at fault and another driver was. We look at who might be at fault for your accident, how to file a claim in Texas, how long you have to claim, how to deal with insurance companies, and how having an experienced personal injury attorney on your side can help you get the financial settlement you deserve.

Car Insurance Claims: Who’s at Fault?

The first step in determining if you can file a car insurance claim is figuring out who caused the accident. Driver error is the most common cause of car accidents, but other factors can be at play, too, such as a fault or defective part that led it to malfunction and the car to crash.

In such cases, you might be able to claim against the vehicle manufacturer or the parts supplier that made the defective component of your car, but this is certainly not an easy process. Finding out if a vehicle or parts manufacturer was at fault requires a skilled personal injury attorney who can arrange tests and get expert statements to back up your claim.

Road defects can also lead to car crashes, such as if a road isn’t properly maintained, has potholes, or is otherwise in a bad state. In this situation, you might be able to sue the local government or the organization responsible for maintaining the road, as they’re legally required to ensure roads, signs, and traffic lights are in good condition and don’t lead to accidents that may cause bodily injury and vehicle damage. Again, you need legal expertise to tackle such a daunting case, and an experienced personal injury lawyer in Texas will know what to do.

More commonly, though, it’s the reckless acts of other drivers on our state’s roads that cause the thousands of auto accidents in Texas every year. Speeding, distracted driving (especially when using cell phones), driving under the influence of alcohol and drugs, and other causes result in the loss of lives and injuries on our roads every day of the year. But even when driver error is the cause, it doesn’t necessarily mean you can file a claim easily. Once again, proving another driver caused a crash you were involved in requires expert legal knowledge and experience from attorneys.

How to File a Car Insurance Claim That Gets Results

A successful car insurance claim relies on solid evidence that proves you didn’t cause or contribute to an accident and that you were injured and suffered property damage.

But what evidence can prove this?

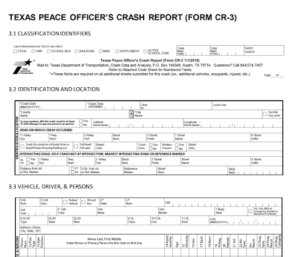

A key piece of evidence for insurance and personal injury claims is an official report from the authorities containing details about the crash, the injuries received, and any treatment. In Texas, this is known as a Texas Peace Officer’s Crash Report or Form CR-3. Once the police arrive at the accident site, they will compile a report on what happened and must file it no later than 10 days after the incident. Crash reports are available for purchase from the Texas Department of Transportation (TxDOT), via its Crash Records Information System. A personal injury attorney can also request this information on your behalf, help you understand what it says and its impact on your claim, and challenge the report if it contains inaccurate information.

Do You Need to Submit a Driver’s Crash Report?

Previously, drivers in a car accident were also required to submit a crash report to the Texas Department of Transportation. This was called Form CR-2 — or “The Blue Form” — and contained information including the driver’s insurance carrier, when and where the accident happened, and who else was involved. However, in 2017, Senate Bill 312 amended the legislature, and a driver’s crash report is no longer required.

If you’re in a car accident, you must phone the police and ensure they fill out Form CR-3 at the site. You can use this document as the foundation of your car insurance claim.

Other Evidence for Your Texas Insurance Claim

When gathering evidence to file a claim, your next priority is your health and any injuries you suffered during the crash. After a car accident, you must get checked out by your doctor or at the hospital, even if you feel fine and don’t think you have any injuries. Something could be wrong, and you might not yet know about it — such as brain trauma or internal injuries. If your injuries get worse, it could also affect your claim, as the insurance company of the other party or driver may claim you didn’t sustain the injury in the accident.

If you have suffered injuries in a car crash, your medical report will outline their extent and the treatment required. You can also use this report as evidence for a personal injury claim, which may entitle you to financial compensation to cover your medical care. The same goes if you’re unable to work and have lost income as a result — a letter from your employer, along with evidence of how much you earn, such as payslips, will help to increase your settlement size to cover this.

How Long Do You Have to File Your Claim?

Keep in mind that the personal injury statute of limitations in Texas is two years from the date of the accident. However, this rule has several exceptions, including those relating to minors and people of unsound mind. Our car accident lawyers offer a free case evaluation and can advise if they apply to you and help you file a claim.

What If I’m at Fault for My Accident?

If you’re partially at fault for your car accident, you might think claiming compensation is out of the question, but that’s not necessarily the case.

Each state has negligence laws, which either bar you from claiming compensation if you’re even slightly at fault, allow you to claim compensation regardless of your level of fault, or allow you to claim compensation providing your fault falls below a certain threshold.

Texas has modified comparative negligence laws, which means you can claim compensation, providing you are less than 51% responsible for your accident.

For example, if you are in an accident because you maneuver your car without signaling, causing you to crash into a car, but the other driver was tailgating you, you are clearly partially liable, but the accident likely wouldn’t have happened if the other driver was not following too closely. In this case, you might be found 40% at fault.

As your fault is below the threshold in Texas, you can still claim compensation, but your settlement will be reduced by 40%. So, if your compensation totals $100,000, you will receive the remaining 60% ($60,000).

Negotiating a Settlement with an Insurance Company

Now we get to the hard part of filing a car insurance claim — trying to get money from an insurance company. Don’t be surprised to learn that insurance companies will do everything and try every trick in the book to avoid paying out a settlement. They are, after all, for-profit businesses — and they want to stay that way. During the claims process, it’s common for an insurance carrier to make a low offer, hoping the accident victim will settle and quickly end the claim.

Experienced car accident injury attorneys know how to deal with the other driver’s insurance company and won’t let them get away with anything. They will fight to get you a favorable outcome, resulting in as much compensation for you as possible. While most claims don’t get to this point, should talks break down or you decide not to settle because the offer on the table is less than what you want or deserve, your attorney will advise you on your chance of success in court.

If you’re wondering how much you have to pay to hire a good car accident attorney, in most cases, the answer is nothing. That’s because most personal injury lawyers in Texas — including our team at Patino Law Firm — work on a contingency basis, so you only pay attorney’s fees if your case is successful.

Are you looking for a top car accident lawyer in Texas who won’t charge you until you win? Fill in the contact form or phone 855-LAW-NINJA today for a free consultation and see if you have a claim. You could be entitled to significant compensation for your injuries, medical bills, lost wages, and more.